Speculation is Dead, Long Live Speculation

Speculation isn't dead, but the old ways sure as hell are.

People on CT know Bonk Guy, but to anyone outside of it, seeing him post a 47-tweet thesis on why a memecoin called USELESS could hit a billion-dollar valuation might look completely insane. Here's a guy constructing elaborate frameworks about market psychology, social media sentiment, tokenomics, and meme cycle comparisons—all for something literally named "USELESS."

To outsiders, it's peak degeneracy. To those paying attention, it's what speculation really is today.

Within weeks, USELESS exploded 2,000% from $10 million to over $200 million. But (as anyone familiar with memecoins/narrative trading knows) the real fascinating behavior was the mimetics around it. Bonk Guy's followers didn't just throw money at it blindly—they copied his entire analytical playbook, his research methods, his terminology, his intellectual justifications.

One guy's sophisticated-sounding analysis became the template for thousands of others, creating this massive echo chamber where everyone thought they were doing independent research while really most were just playing a very expensive game of telephone.

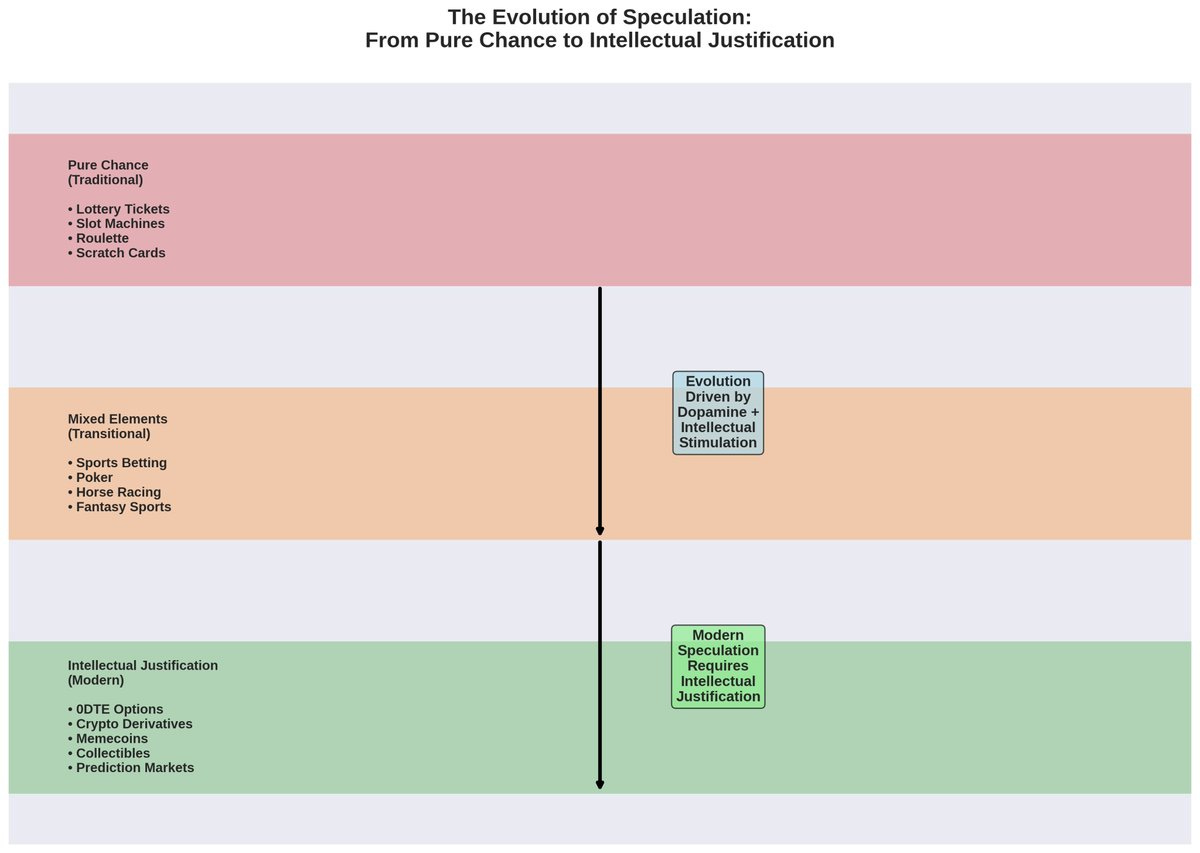

This hypermimetism isn't unique to memecoins. It's driving an entire ecosystem of what I call "intellectual speculation"—zero-day options trading, perpetual futures, prediction markets, collectible investing, etc.. Each requires participants to think they understand complex systems, share analytical frameworks, and feel intellectually superior to traditional gamblers. This is the New Age of Speculation.

We can empirically see this shift.. Traditional casino stocks are hemorrhaging value—MGM Resorts at $37.67 near its yearly low, Caesars Entertainment at $29.64, down 35% from its peak with a market cap of just $6.16 billion. Lottery sales dropped 30% when Mega Millions raised prices despite bigger jackpots, and the Las Vegas Strip lost money last year.

Meanwhile, intellectual speculation markets are exploding with triple-digit growth rates. Like 0DTE options—zero days to expiration, one of the most mathematically complex forms of speculation imaginable. These went from 5% of S&P 500 options volume in 2016 to 43% by 2023, then 61% of SPX volume in May 2025—a 1,120% increase over nine years. Daily volume hit 2 million contracts, up 29% year-over-year, with the Options Clearing Corp reporting total volumes rose 10.9% to $12.3 billion. 0DTE traders are looking for massive outcomes, and want to pretend like they understand the underlying factors. It’s certainly a lot more intellectual sounding than running roulette.

Perps, of course, aren’t any different. CT’s favorite trading platform- Hyperliquid- recorded $1.571 trillion in annual trading volume, with their HYPE token hitting $40.07 (as of when I wrote this) and achieving a $13.4 billion market cap—worth more than Caesars Entertainment despite launching last November. That’s Hyperliquid alone- it doesn’t encapsulate the data around CEX trading volume, OI across the board, other competitors like Lighter/EdgeX. And we see this in countless other forms of “intellectual speculation”:

Trading cards hit $13 billion in 2024, projecting 61.5% growth to $21 billion by 2034 with Fanatics generating $8.1 billion in revenue, up 15% year-over-year (and countless more private platforms absolutely ripping like Courtyard).

Pop Mart, the company behind viral Labubu collectible figures, trades at 258.20 HKD with potential 724% gains from its 52-week low, achieving a market cap of 342.93 billion HKD largely off the Labubu hype train.

Prediction Markets: Both Kalshi and Polymarket recently raised massive rounds at multibillion dollar valuations as an index bet on information speculation; both have seen explosive growth in volumes over the past year (largely due to the election, but they continue to sustain to many people’s surprises).

Memecoins: Pump.fun has generated $677 million in revenue with 5.7 million new memecoins created, and trading terminals like Axiom and Bonkbot are doing mindboggling numbers monetizing flow and discovery (I believe Axiom was one of, if not the fastest, growing company ARR wise in YC’s history). We’re seeing new launchpads like Launchcoin targeted at specific segments (i.e. ICM) every single day, several memecoins continue to sustain 1B+ market caps, and unlike NFTs I think memecoins are here to stay as they provide a constant draw of new markets around IP, events, memes etc.

But here's what's fascinating: the analytical frameworks spread across all these markets identically. Whether someone posts about "Greeks and gamma exposure" in 0DTE options, "perpetual funding rates" in crypto derivatives, "rarity mechanics and floor prices" for Labubu collectibles, or "narrative dynamics" in memecoins, the pattern is the same.

One person creates sophisticated-sounding analysis, hundreds copy and adapt it, and suddenly entire communities use the same terminology and intellectual justifications for gambling with extra steps.

The psychology runs deeper than wanting to feel smart. We've been conditioned by the internet to believe we can analyze everything, and we want to share these insights to signal intelligence. Research shows people with higher IQs actively avoid pure chance gambling but gravitate toward anything that feels skill-based.

These same individuals aren't avoiding risk—they're demanding the illusion of intellectual sophistication with their adrenaline rush, and they want to spread that illusion through mimetic communities.

This explains why platforms enabling intellectual speculation create generational wealth while traditional gambling companies stagnate. DraftKings made $4.8 billion by positioning itself as an analytics playground where complex parlays make bettors feel like analysts (combined with a robust community of betting influencers/ tailing picks). The mimetic spread creates powerful network effects that traditional gambling cannot replicate.

Traditional gambling companies find themselves trapped because they can't create communities of intellectual-sounding analysis. You can't build sophisticated frameworks around slot machines or develop comprehensive analytical communities around roulette wheels. The social element that makes people feel intellectually superior is fundamentally missing.

The difference isn't the underlying risk—it's whether participants can construct intellectual justifications and share them with communities that validate their sophistication. We're not becoming less willing to take risks; we're becoming more demanding about feeling intellectually validated while we do it. In fact, some of these markets have strictly worse odds than most casino games.

The future of speculation belongs to platforms that understand this psychology and the power of mimetic behavior, creating environments where people can share, copy, and spread intellectual-sounding analysis while they speculate.

In turn, we're witnessing the death of “mindless” speculation. If we're going to speculate anyway—and humans always will—at least now we're exercising our cognitive abilities while we do it, even if we're mostly just copying each other's smart-sounding justifications for taking risks.

People in crypto have known this for a while- from BTC being the God meme, to ICOs, to the sustained liquid valuation of many alt assets as narrative bets on things like programming languages (i.e. “MOVE”) or sectors (yes, like AI). Of course, the assets that outperform tend to (1) encapsulate those narratives and (2) have good fundamentals, but it's hard to remove the speculative premium that is endemic across assets.

But we’re now seeing this play out in every market, on every scale. It makes sense why there’s so much buzz around stocks onchain and many traders in the space foraying into equities- some of these equities act the same way assets in crypto do (on narratives).

The casino floor is dying, but speculation has never been more alive. It's just wearing a lab coat now instead of a lucky rabbit's foot—even if that lab coat is mostly for show, and even if everyone got their lab coat from the same place.